This is a follow up from the previous post: https://www.investment-in-stocks.com/investment-in-stocks/the-one-idea-that-made-value-investors-successful-investors-part-1

Moving on, we will use a real life example to calculate the Intrinsic Value of a Stock and will add in more real life variables using this example.

Example of Calculating Intrinsic Value of Walmart (WMT)

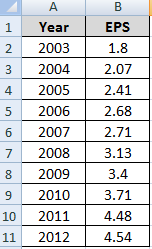

First of all, we will take a look at the past 10 years record of Walmart. To project Walmart’s future earnings, we will take a look at its past earnings. And since we want to find the Intrinsic Value of the stock, we will look at the past 10 year’s Earnings per Share (EPS) to project future EPS.

Step 1: Calculate Past EPS Growth Rate

Based on the 10 Years Records, we can calculate the EPS growth rate using this formula,

Growth Rate = (Future Value / Present Value)1 / Y – 1

Growth Rate = (4.54/1.80)1/9 – 1 = 10.83%

where

y = Number of Years to Grow.

we can also use the Compound Annual Growth Rate Calculator at http://www.investopedia.com/calculator/CAGR.aspx#axzz1xiSxrnB2

We have found the growth rate of WMT to be 10.83% for the past 10 years.

Note that the number of EPS data is 10, but the number of years for EPS in 2003 which is $1.80 to grow to $4.54 in 2012 is only 9 years.

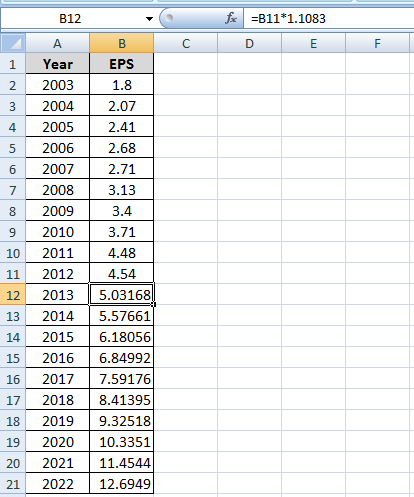

Step 2: Project future 10 Years EPS

Using the growth rate of 10.83%, we can project the EPS for the next 10 years. This can done using an excel spread sheet.

From the figure above, you can see that I have keyed in the formula “=B11*1.1083” in CELL B12. This will multiply the EPS in 2012 which is $4.54 by 10.83%. This is projecting the EPS one year later. To continue to project it 10 years down, we can copy and paste the formula from CELL B13 to B21.

The picture will look like this:

Do note that if the growth rate for the past 10 years is very high, say above 50% and we do not have the confidence that it will continue to grow at 50%, we can always adjust it down to 20% or even 15% to project the future EPS.

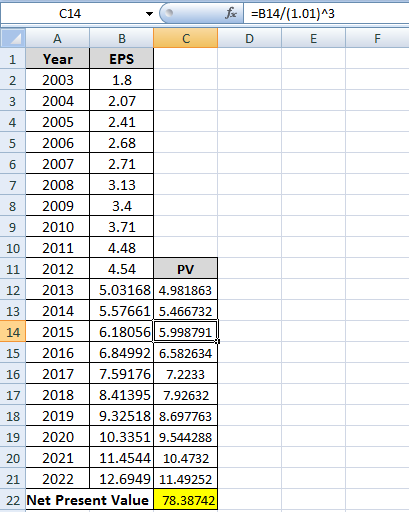

Step 3: Calculating the Net Present Value of All EPS/ Intrinsic Value of Walmart

As what we did with the earlier example, we will discount all the EPS of Walmart using the Opportunity Cost of Investment. For this example, we will continue to take OCI as 1%. We will do this using the excel spreadsheet with the given formula of

Present Value from Future EPS = Future Value/ (1+OCI)n

Where n = number of years later, thus the number of times to discount.

Using the print screen as a reference, you can see that CELL C14 is selected and in the formula =B14/(1.01)^3.

This is taking the projected EPS in 2015 which is 3 years later from CELL B14 and dividing it by (1+ OCI) to the power of 3 (because it is 3 years from today).

If you select CELL C15, you will see the formula to be “B15/(1.01)^4.”, CELL C16 = “B16/(1.01)^5.” and so on.

The get the Net Present Value of all the future EPS, we add all the discount value together and get $78.39.

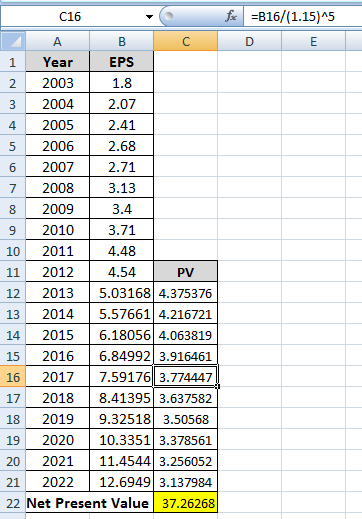

TO NOTE: Different Opportunity Cost of Investment (OCI) for every investor. The calculation of Intrinsic Value is subjective because the OCI for everyone is different. Some experienced and seasoned investors can find investments with higher rates of returns of even up to 15% per annum and thus when they analyse the same business, such as the one above, the value if the business is much lower since they discount it at 15% instead of 1%.

In the case where the OCI is 15%, the Intrinsic Value of the Business will be as follows:

So to the investor whose OCI is 15%, Walmart’s shares are worth $37.26, but to an investor whose OCI is 1%, Walmart’s shares are worth $78.39.

Something to note is that OCI can also be viewed as your desired returns. If you want to achieve 10% per annum, you can use OCI as 10%. There isn’t a magical figure or a fixed rule. The key is to understand the rationale behind what we are doing and you can adjust accordingly.

Step 4: Adding a Margin of Safety

Now we have understood how to calculate the Intrinsic Value of a share, but the story isn’t over yet. Like we mentioned, the key power of Value Investing is to give the stock a value. But when do we buy the stock? The answer is when it is selling at BELOW its value. How amount below the value which we want to purchase the stock, is known as the Margin of Safety. So in the example of Walmart, the shares are $78.39. And as stated, the calculation of Intrinsic value is always subjective, so we want to give ourselves some space to for error so that in event we are wrong, we are still making a good investment.

A rule of thumb is to give a 15% Margin of Safety. So in this case, we will purchase Walmart stocks if it is selling at $78.39 * (1-15%) = $66.63. , this is if your OCI is 1% or your desired returns is 1%.

Now, we can adjust the Margin of Safety based on the confidence we have in the business we are investing in. So if you are very confident in the records of Walmart and believe that it can continue to grow for the next 10 years, we can even adjust the the Margin of Safety down to 10% or even 5%. On the other hand, if we are investing into a relatively volatile stock, we can also adjust the Margin of Safety up to 20% or even 50%.

As you can see, calculating the Intrinsic Value and Setting a Target Buy Price is subjective but always very logical and is made from a business perspective.

Come join us for a free workshop to learn how to do this and profit from the market:

Click HERE to book a Free Investing Workshop.

To your dreams,

Mind Kinesis Research Team

Master Trainer (Value Investing Options Strategy)

Investment in Stocks Blog

Value Investing Academy – the Warren Buffett Way

https://www.investment-in-stocks.com,