Hi Investors,

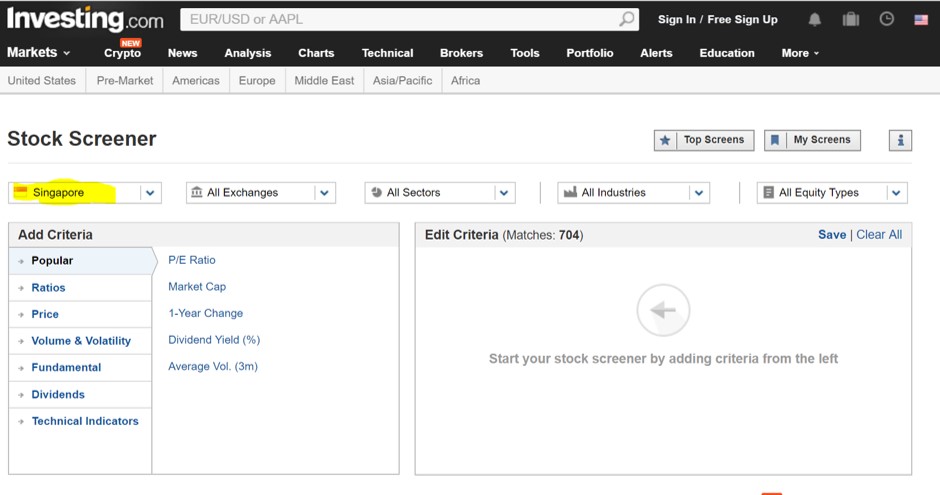

The first step for you to find a good stock in the Singapore exchange is to use a screener.

https://www.investing.com/stock-screener

We can find the screener at the above address. On the website, remember to change the area highlighted in YELLOW to “Singapore” to screen for SGX stocks

Next, you have to define the criteria to screen for good stocks in SGX.

How do you add criteria to the screener?

If you want to set “Dividend Yield” as your criteria, go to the “Add Criteria”, click on “Dividend”; then click “Dividend Yield (%).

Once you click on “Dividend Yield (%)”, you will see it appear in the “Edit Criteria” box.

How do you edit the range?

You can EITHER move the slider OR type the value that you wish to set.

Repeat the above-mentioned steps to add all the criteria you wish to have for your screener.

There are a lot of criteria we can use to screen for good stocks in SGX. However, out of all these criteria, there are 3 specific criteria that Cayden recommends:

- Earnings per Share (EPS)

- Dividend Yield

- Return on Equity (ROE)

You can see that both EPS & Dividend Yield can be found in the criteria selection list above. Unfortunately, ROE is a criterion that cannot be found in the investing.com screener criteria selection list. Nevertheless, not being able to use ROE as a criterion will not be a big issue as we can always find the information from other screening tool, e,g Morningstar.

Earnings per Share (EPS)

To screen for a good stock in SGX, one of the important criteria is to get a positive and up-trending EPS.

Growth in EPS is an important measure of management performance because it shows how much money the company is making for its shareholders.

To calculate EPS of a business,

Earnings (or net income) can be found from Income Statement, while Total Shares Outstanding can be found from Balance Sheet.

By using the screener, you can easily select the criteria you wish to use to screen for the companies that fulfil your requirements.

Dividend Yield

As a value investor, we want to buy cheap and good stocks, and we want to hold them for long term while waiting for capital appreciation.

While holding the stocks, we, as investors, would like to receive “ang pows” from time to time. The beauty of a good business is that it will often pay out dividends on a quarterly basis to investors that own their stock. This is a very welcome benefit of owning shares.

In the 4 days Value Investing Program(VIP) we were told that, as a guideline, a good company has a dividend yield of 3% or more. Again, by using the screener, we can easily screen for the companies that is paying >3% dividend yield.

I personally prefer to set the criteria for dividend yield to a less stringent >2.5%. Setting this less stringent criteria on the screener will flag up a wider range of companies for me to choose from.

Return on Equity (ROE)

Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders’ equity. The ROE ratio is important because it compares how profitable a company is against its peers. The ROE has to be >15% to consider a good company.

To calculate ROE = Net Income/Shareholders’ Equity.

As investing.com stock screener does not have an option to set ROE as a criterion; we should follow up the screener’s results with a cross reference on a company’s ROE from another source (such as Morningstar).

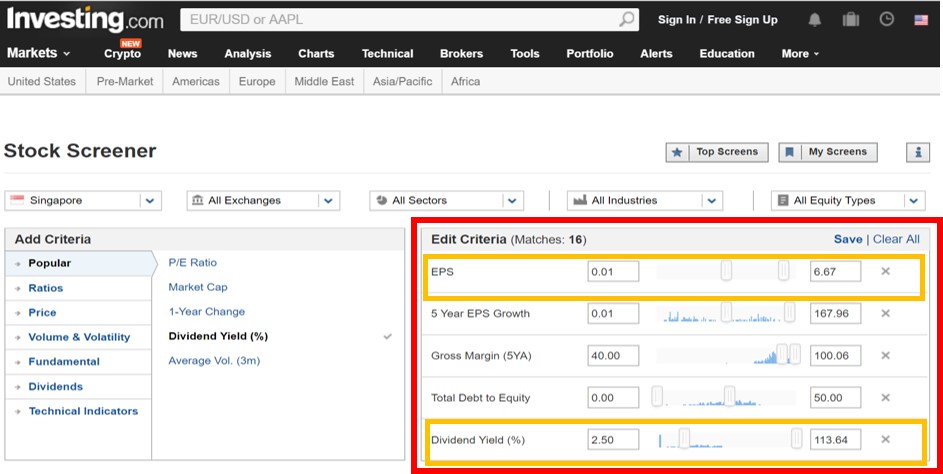

Adjusting the criteria stringency

As mentioned before, if we want to get the very best companies, we have to be very stringent with our criteria. However, if we want more options, we have to be less stringent with the criteria. Based on just 5 criteria listed below, you can see that the screener has found 16 companies.

- Quick Ratio >1

- Total Debt to Equity ratio <50%

- Dividend yield > 2.5%

- Current Ratio >1

These criteria are listed in the following diagrams for your easy reference. There are also some explanations below explaining what the P/E ratio, Current Ratio and Quick Ratio are and what exactly they measure.

As you can see from such stringent criteria, only 3 companies can be found from the screener.

P/E ratio

P/E Ratio =

The P/E ratio divides a stock’s share price by its earnings per share to come up with a value that represents how much investors are willing to pay for each dollar of a company’s earnings. The P/E ratio is important because it provides a measuring stick to compare valuations across companies.

The higher the P/E ratio, the more the market is willing to pay. This could also indicate that the current share price may be above the stock’s intrinsic value. If the share price is above the stock’s intrinsic value, we should, as taught in the 4 day VIP course, not buy the stock.

Quick Ratio

Quick ratio =

The quick ratio is an indicator of a company’s short-term liquidities and measures a company’s ability to meet its short-term obligations with its current assets.

The higher the ratio means the company is in a good position to pay back its short-term liabilities if it needs to.

However, having a too high quick ratio may indicate that the company has too much cash sitting in its reserves. It may also mean that the company has a high account receivable, indicating that the company may be having problems collecting on its debtors.

Therefore, if a company you are keen to invest in has a high quick ratio, it is always a good idea to find out more detail by checking the company’s balance sheet before buying their stock. Remember: Do your due diligence!

Current Ratio

Current Ratio =

The current ratio is a liquidity ratio that measures a company’s ability to pay short-term and long-term obligations.

A current ratio that is <1 indicates that the company’s liabilities are greater than its assets. This might mean that the company may not be able to pay off its obligations (both short term and long term) if they came due.

Conclusion

As mentioned before, we, as value investors, should do our own due diligence before we decided to invest in any companies. The screener is just a tool to aid us by highlighting the companies that fit in to our criteria. It does not mean that we should blindly invest in every stock that gets flagged up. If we do, we are being ignorant, and that will lose us money.

Never forget rule number 1, Never lose money!

To your dreams,

Mind Kinesis Research Team

Click here for our Free Value Investing Guidebook :

Would you like to accelerate your training on investments? Click here to join our Free Value Investing Masterclass In Singapore :

Click here to hear what our graduates have to say about the value investing course in Singapore :