Ever thought about becoming a millionaire? This is the first part of a 2-part article on how we are able to achieve $1 million. In this very first article, we will share how someone in their 20s is able to achieve this amazing milestone. Caution: This will not be a short and easy journey, but will definitely be a very rewarding one.

I believe everyone agrees that it is fairly easy to make a million dollars if you inherited $1 million, strike the lottery or if you have hundreds of thousands to buy and sell properties.

However, let’s be realistic. Most of us do not have that much money to begin with. This is especially truer when most of us are just employees and are living paycheck by paycheck without any forms of other income.

To illustrate this further, people in their 20s does not have much income and money to begin with. On top of that, these people must battle temptations in life such as buying expensive stuffs like branded bags and watches, and not to forget, the perks (and the high cost involved) of owning a car. Add in marriage and buying your very first house into the equation and you will realize that you are getting even further away from hitting $1 million. So, how could someone in their 20s be able hit $1 million in their lifetime? The emphasis here will be on Save & Invest.

What would you do if you have $1 million?

Before we began, I would like all of you to take one step back and think carefully why do you want to have a million dollars? It is only when we have set a purpose; we will be more motivated to work towards and achieve our goals.

Food for thought – At the end of the day, have you ever wondered what will happen after you hit $1 million? Some people wants to be a millionaire as it is one of their goals in life, some people wants it so that they are able to give their family a better life or to have a more comfortable retirement, and some people believes that by having that much money, they are able to help others. What about you?

Savings

Most of us are not born rich, nor are we that fortunate enough to inherit a fortune or even strike the lottery. So, where will our $1 million come from? Savings! Every single dollars and cents we saved will build towards hitting the $1 million. For people in their 20s, here are 3 simple points we can take into consideration to increase your savings.

Pay Yourself First – The moment you receive your monthly paycheck, always assign at least 10% as savings into a completely separate (and usually harder to access) bank account immediately. In other words, you are actually forcing yourself to save 10% of your income upfront.

Budget – Always prepare a budget to manage to your expenses. By budgeting, you are in fact, planning your expenses in advance. This way, you are able to set a clear expectation on what you need to spend on a daily/weekly/monthly basis and at the same time, analyze your past spending and adjust them accordingly where necessary. It is also highly recommended to set up a separate budget if you have plans to buy a car, a house or wedding expenses. Remember, if you fail to plan, you plan to fail!

Be Frugal – Frugality is a virtue. It simply means not buying stuffs you cannot afford or do not need. At the same time, while buying stuffs that you need, you will try to choose the cheapest option as much as possible. For example,

- Expensive stuffs like branded bags or watches –It is really worth it to spend so much money on such stuffs? Do they add any value to your life or do you really need them in the first place or if there are other cheaper alternatives that serves the same purpose?

- Car – Despite being a very convenient tool, owning a car is not cheap. On top of the monthly car installment you need to fork out, you will also need to pay for petrol, car park, repair and maintenance, etc. Does a car make your life more convenient or yourself poorer?

- Lifestyle – Eating at restaurant versus eating at food court. At the end of the day, both are simply filling your stomach. Does it matter if you spend more or lesser on food?

The process of paying yourself first, setting up a budget and live frugally will enable you to save more than any other people out there and bring you closer to your goal. However, at this point of time, you might realize that it might take forever to save a $1 million with those little savings here and there. With that, let me introduce you to investing, a concept which will allow to get our savings work for us.

Investing

Investing is often the simplest method, and yet the most misunderstood method to grow your money. Many people often picture investing as a risky vehicle that leads to losing all our hard earned money.

However, many people do not know that, it is through proper investing techniques, that one can really grow their money. Warren Buffett is one great example. Using the methodology of Value Investing, Warren Buffett managed to grow his wealth at an estimated annual return of 20%, becoming one of the richest men in the world. Amazing isn’t it? And you can do it to!

If you felt that you are running out of time, do not have a wealth mentor, and want a packaged solution to learning how to build wealth through a value investing approach, do visit this FREE preview and see if it works out for you. There are 2 sessions on 27 November and 10 December 2015.

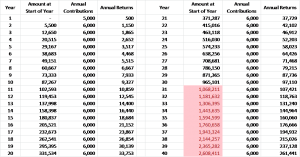

Let’s take a look at the table below. Assuming you start investing with only an initial savings of $5,000 and contribute an additional $2,400 a year ($200 a month), you will be able to achieve $1 million within 39 years at an average annual return of 10%.

Is 39 years too long? Now, let’s assume you are able to save and invest more monthly because you have been paying yourself first, setting up a budget and live frugally. The same initial savings of $5,000 plus the annual contribution of $6,000 ($500 per month) will allow you to be a millionaire in 31 years instead.

Is 31 years still too long? Good news – Have you notice that the above table assumed a fixed annual contribution of $6,000? We did not take into consideration of any additional contributions that you could have made in future. For example, when you receive a promotion or a pay raise, you would be able to contribute more as your income increases.

In addition, the above tables are computed based on an assumption of a fixed average annual return of 10%, which is the estimated annual return of the Singapore Stock Market. Imagine that you have acquired extensive investment knowledge and are able to increase your average annual returns; you will be able to hit $1 million much faster.

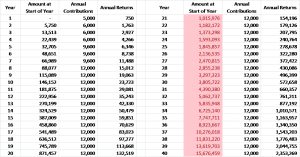

Let us use the following assumption. We will still start with an initial savings of $5,000, with a periodic increase of annual contributions (up to a capped of $1,000 per month) and an average annual returns of 15%. From the table below, you will notice that you are able to be a millionaire within 21 years.

In other words, by knowing how to invest properly, you could possibly increase your returns using a shorter time frame and achieve $1 million earlier.

It could be a long and boring journey (as much as 20 to 40 years) to achieve $1 million. However, as long as you equipped yourself with the right mindset, right knowledge, start saving and investing now, you will be on your way to achieve $1 million.

Rais Bin Mahmud

Project X Member

Interested to learn more, STEP-BY-STEP, about how you can save and invest better? Click HERE for a free 2.5-hour Value Investing Masterclass to find out more!