Hi Friends

Once in a while, we would have queries about investment related queries, etc. and there were 2 queries which are as follows:

1. How can value investing protect one in a black swan?

2. How can value investing help one profit in a black swan?

As I find the queries an interesting one, I have decided to write a post about it.

From the question itself, don’t take “Black Swan” literally. Based on Investopedia, it means:

“An event or occurrence that deviates beyond what is normally expected of a situation and that would be extremely difficult to predict. This term was popularized by Nassim Nicholas Taleb, a finance professor and former Wall Street trader.”

1. How can value investing protect one in a black swan?

Before I can answer this question, you will need to know what value investing is all about which can be found in the following articles:

1. https://www.investment-in-stocks.com/whatisvalueinvestingpart1/

Now, if you have read the above article, you will have some understanding about value investing. There are a few keys in value investing that helps a retail investor to mitigate any unexpected events or Black Swan in their investment:

- Circle of Competence – The companies that you have invested must be within your circle of competence. In other words, you are extremely familiar with how the company operates, the business model, its possible future. This is to ensure that you have an edge as compared to those on the other side of the trade and when expected events occur, you won’t panic and do something foolish such as selling away a great business when the event has nothing to do with the company.

- Wide Moat – The company has a wide economic moat. This will ensure predictable earnings even during bad times and unexpected events.

- Great Management – Companies with good management (honest, integrity, deliver what it sets out)

- Undervalue Price – You would have purchased the company at a right price (ie. below how much it’s worth) with a margin of safety (ie. buffer for error in calculation)

- Portfolio Management – You have a portfolio of stocks across a few industries. Professor Bruce Greenwald recommends 15 stocks across 7 industries.

Do note that the market value (stock price) got nothing to do with the business value (intrinsic value) of the company in the short term. In other words, sometimes an event will happen which will affect the company’s stock price but it’s got nothing to do with the company. Let me give you one of my personal experience, in Aug 2011, S&P, a US Credit Agency downgraded US Credit Rating from AAA to AA+ (read more at http://www.bloomberg.com/news/2011-08-06/u-s-credit-rating-cut-by-s-p-for-first-time-on-deficit-reduction-accord.html), the share price of most of the companies plummeted and some as much as 30%. So my question is this – if you have invested in Macdonalds before this event took place (which was unexpected by the way) and on 7 Aug 2011, the share price of Macdonalds fell by 6.8% (see chart below), would you sell away the stocks knowing that every single person in the world is still consuming burgers and the revenue is not affected?

Let me put it in another way – the business is still continuing to make money for you (the revenue did not decrease by 6.8%) at that period of time and it’s now selling at a further of 6.8% discount. What will you do? If you have existing position in this stock and you are a value investor, I don’t think you will sell away the stocks. You may even consider to invest more. You see how having the knowledge will protect you from making silly decision during a Black Swan event. On the other hand, if you do not have any position, you may consider to invest in Macdonalds then. Guess what happen to the stock price a few weeks later?

2. How can value investing help one profit in a black swan?

This is pretty much answered in the above where value investors can buy a piece of fine business at an undervalue price.

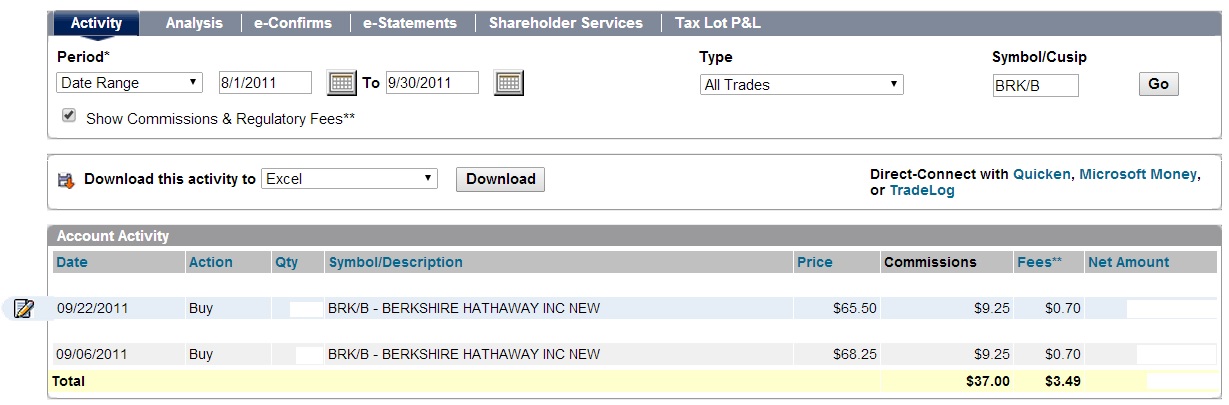

I have attached a screen shot where I have placed 2 trades for Berkshire Hathaway (BRK/B) where the first trade was US$65.50 and the 2nd one was US$68.25. The current price is now US$121.70 (as of 14th Apr 2014), a WHOPPING 78.3% to 85.8% within 2.5 years. Imagine your boss suddenly decides to increase your pay by this percentage. Unfortunately, I sold off a bit too early though I have made a good sum.

Have fun investing and join us in our coming Value Investing Workshop!

Cheers!

Cayden Chang