Dear friends,

Today, I would like to share a valuation method known as the Earnings Power Value popularised by Professor Bruce Greenwald from Columbia University. Columba University, by the way, in some sense is where Value Investing was given birth to when Profession Benjamin Graham and David Dodd started formulating and teaching the ideas there.

As no valuation method is perfect, Prof Bruce Greenwald prefer to look at a company’s current value rather than project its earning into the future. In my later posts, I will share what he also term as Asset Reproduction Value and Franchise Value. But for this post, I will touch on how he valuates a company by looking at its Earnings Power Value (EPV)

For the sake of discussion, I will be using a relatively straightforward company – SATS Services. When I say straightforward, I really mean its business model.

Basically, what is does is to provide comprehensive scope of gateway services encompasses airfreight handling, passenger services, ramp handling, baggage handling, aviation security and aircraft interior and exterior cleaning, while its food solutions business comprises inflight catering, food distribution and logistics, institutional catering as well as airline linen laundry.

We will be going through step by step and the key idea being EPV is to find a more accurate distributable cashflow or ‘money owners can extract from firm and leave operation intact. The idea is that what we can extract from the business every year and still leave it intact, is what is really worth to us as shareholders. So as SATS continue to run its business, we want to find out as accurately as possible, how much can we take from it s owners.

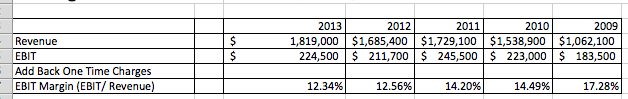

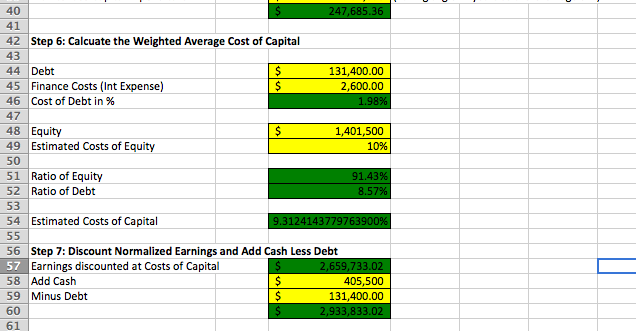

Step 1: Find an adjusted and reasonable Earnings Before Interest and Tax (EBIT) Margin.

We will look at the past 5 year’s average as a benchmark. We can use even 7 years or 10 years. This is to account for economic cycle and lok at margins even when the economic down.

Personally, I will choose an adjusted EBIT Margin of 12.3%. The reason is that i can observe that margin seems to be dropping. Actually,, this may be a concern altogether, but for the sake of discussion, i believe that SATs services will continue to be able to be in business and maintain its margin even at the lower end of the spectrum. Also, note that we are suppose to add back one time/ extraordinary charges or income to find a figure that is normalized and that we can reasonably expect. In SATs case, I skimmed through and did not find any. We may need to do a more indepth study on it, but this being a case study for the valuation method, I will move on with this assumption.

Step 2: Normalize the EBIT by multiplying a reasonable estimate of revenue (usually current revenue), by adjusted EBIT Margin

Taking current year revenue of $1,819,00 x 12.3%, i will get $223,737.00

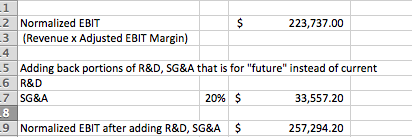

Step 3: Add back R&D costs and SG&A costs that are attributable to the “future”.

Since we want to identify amount of cash we can extract from the business, we assume that certain portions of R&D and SG&A are taretted for building future businesses. For EPV, we are conservatively assuming that there is no growth and the expenses attributed to getting future businesses can be extracted today and the business will still be intact.

I realised that SATs services does not have R&D costs (actually not surprising given their simple, service oriented business.) For their SGA costs, I will take a ball park figure of 20% and add it back to EBIT.

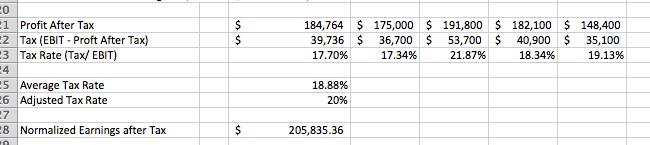

Step 4: Find a tax rate and find Earnings after Tax.

After looking at their tax rate for past 5 years, I decide on using the higher bracket of 20%.

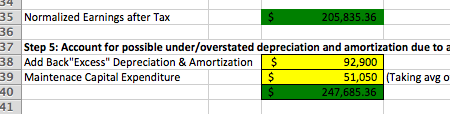

Step 5: Account for possible under/overstated depreciation and amortization due to accounting standards by adding back depreciation and amortization and deduct Maintenance Capital Expenditure instead.

The rationale is that accounting standards may not reflect the true depreciations and amortization of the business assets. We are also assuming that Maintenance CAPEX is the more accurate measure. It will be best if we have a clear understanding of the business and its asset. When unsure always be prudent by overstating expenses and understating earnings.

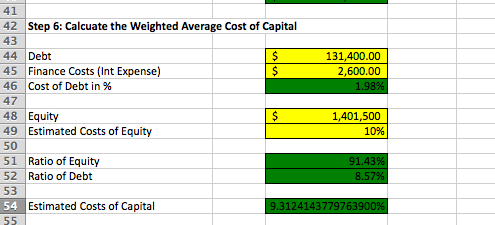

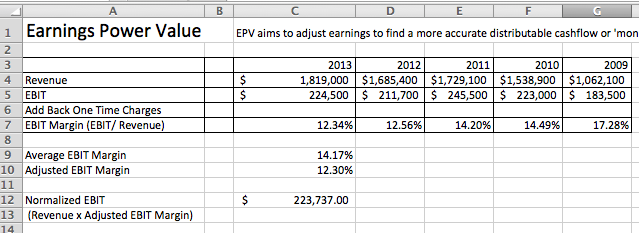

Step 6: Calculate the Average Cost of Capital

Well, for this portion, we want to assign a discount rate, or in my own words, an expected returns from this business. Since we are placing our money in there, we want to assign a returns (which is a costs to the company) on our capital. See screen shot and I will explain.

Capital, which finances the companies operation is made up of either Equity (what the shareholders actually put in and what the business keeps after making an income) as well as debt (what the business borrows at an interest)

Based on the Financial Statement of SATs, its debt is $131,400 and its Equity is $1,401,500. So we can see the percentage is 8.57% in debt and 91.43% in Equity.

The cost of debt is around 1.98%. I got this figure by taking the interest expense and comparing it to the total debt. This may not be the most accurate way to do it, but I am comfortable with this figure as I read the reports on its financing and the interest rates it is paying on average is also around less than 2%.

The cost of equity is very subjective. What would the shareholder expect the company to perform? I will take a ball park of 10% (i have no explanation for this, but i will discuss this a little further later)

The average cost of capital is thus 9.31%

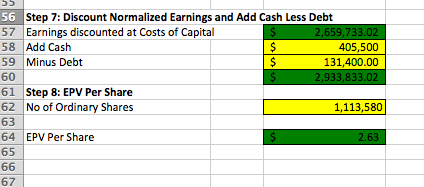

Step 7: Discount Normalized Earnings and Add Cash Less Debt

In this step, we discount the Earnings of $247,685.36 by the cost of capital of 9.31% and we get $2,659,733.02.

Now, why do we do that? The rationale is that since we believe that the true adjusted earnings of SATs is $247,685.36 and we expect 9.31%, we will be willing to pay $2,659,733.02 for the business. Because if we pay $2,659,733.02 for the business and it continue to make us $247,685.36, we get 9.31%, which is the costs of capital.

I want to add my own opinion and ask, are you satisfied with 9.31%? Personally, I will rather discount it back by 15%! Because I want 15%, not 9.31%. Like my friend Ser Jing ask, so it is worth is to buy a business that seems undervalued based on a costs of capital of 4%?

He also shared with me story:

“Tom Gaynor from Markel has a daughter studying finance. She was doing a project about valuing companies and they have to find the cost of capital. They spent hours on it and finally have a number. After that, she asked her dad “how do u actually do it?” His reply was, “Oh. I just use 10%””

Warren Buffett says:” The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.”

Anyway, with all due respect, lets move on with this exercise.

Since we want to calculate the current “intrinsic value” of the business, we will add in cash less debt because this is also, technically speaking, owner’s cash and is accessible to owners.

Step 8: Calculating EPV Per Share

Finally, we take the EPV divided by number of ordinary shares.

And what we get here is $2.63 per share.

I do hope you benefit from this exercise and do let me know if you have any comments and I look forward to it and will love to learn from you too.

To learn more about how to invest, join us in our Free Investing Workshop at <<www.valueinvestingprogramme.com>>.

Mind Kinesis Research Team