Investing In Facebook – The largest social media company in the world

SUMMARY

- Facebook continues to dominate the online target advertising space as it plays the role of the largest social media company in the world

- Excellent financial metrics, growth prospects and a formidable economic moat should make this company an attractive investment for the long term

- CEO Mark Zuckerberg has demonstrated that good leadership matters and his 15% stake in the company speaks volumes about him

- As more web traffic moves to mobile, Facebook continues to attract more advertisers and deepen its relationships with existing clients

- Introduction

As a long-term investor, I am an avid student of great businesses – organizations that are winning not only for shareholders but also for employees, customers, and the world at large. My goal, as a research analyst, is to pack your portfolio with the finest companies and for you to reap the rewards of buying and holding as they deliver market-crushing returns for years and years to come.

As part of my research, Facebook (NASDAQ: FB) is just such a company. As a user of the platform, I have followed its meteoric success as it connects millions of people across its networking services, creating enormous economic value from virtually nothing.

Facebook has all the qualities I admire in a company: crown-jewel leadership, multiple sustainable revenue streams, high growth, solid financials, and huge global opportunities. After reading through its most recent quarterly earnings, it’s a prime time for you to think about connecting with Facebook.

- Business Performance

In 2016, the company’s revenue and profit soared tremendously through the various revenue streams that the business generates.

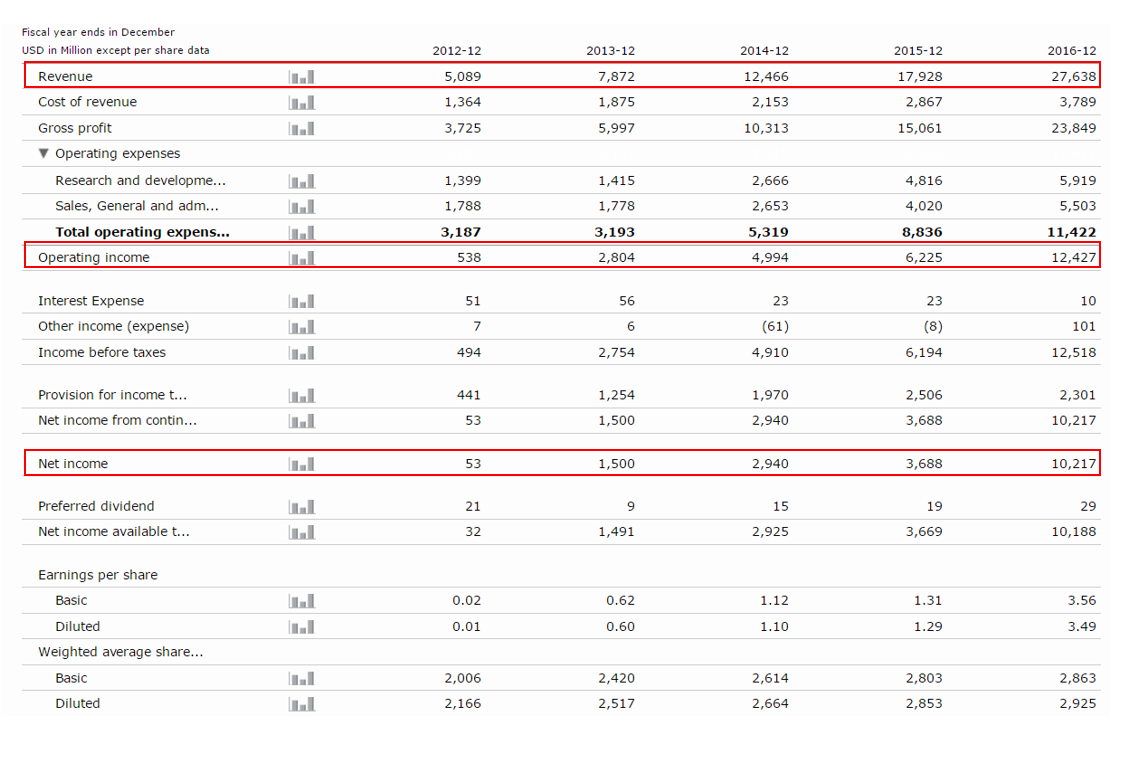

Source: Morningstar

Over the last 5 years since it has become a public company, Facebook’s stratospheric growth has pushed its market capitalisation past some of the largest companies on the stock market. JP Morgan (NYSE: JPM) and Exxon Mobil (NYSE: XOM) – both of which are giants in their respective fields – are now smaller in size than Facebook. Revenues have grown more than 5 times while operating income soared by a multiple of more than 10. Needless to say, its net income – a metric every investor should be concerned about – has rocketed by almost 20 times.

If you think that this growth story has come to an end, look again.

In the first quarter of 2017, revenue and profit skyrocketed by 49% and 76% respectively to land at $8 billion and $3.1 billion. Facebook’s mobile advertising revenue now accounts for the majority of the company’s revenue (85%).

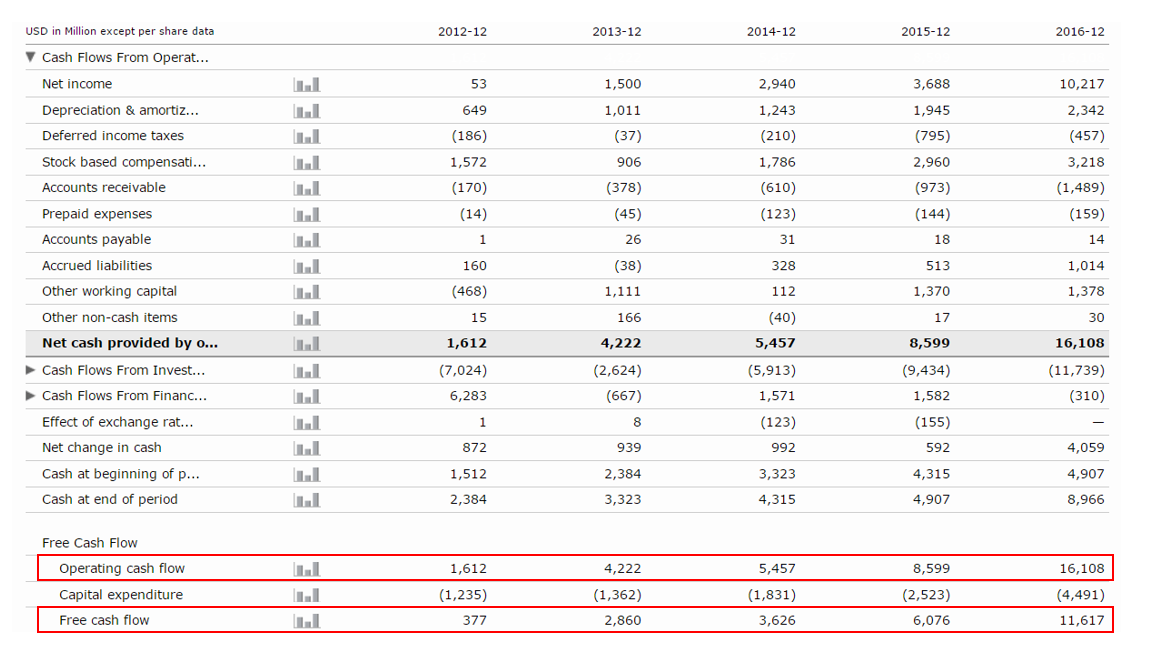

Source: Morningstar

To say that the company’s operating cash flow and free cash flow has been growing at a healthy clip would be a huge understatement.

- Sheer Network Effect

Facebook boast 1.9 billion monthly active users (MAUs) which is more than half of the entire world that has access to internet connection. What is more shocking is the fact that it has 1.1 billion daily active users (DAUs). These figures do not even account for the users of the global messaging app WhatsApp or the mobile photo-sharing application Instagram, both of which Facebook owns.

Facebook makes its money through advertising, and behind Zuckerberg and COO Sheryl Sandberg, the company is getting better and better at it. Let’s face it – more people are using social media on their mobile devices. At the same time, more advertisers are turning away from traditional media to mobile platforms to reach their customers. Facebook targets both PC and mobile platforms with ads in users’ news feeds. While the cost-per-click on mobile is more expensive due to a small screen of your mobile phone as compared to your PC, they also have higher success rates. This means that everyone wins, especially Facebook.

Here is what Zuckerberg said in the company’s FY17 Q1 earnings call:

“Building global community is bigger than any one organization, but we can help by developing social infrastructure for community — for supporting us, for keeping us safe, for informing us, for civic engagement, and for including everyone.”

If this doesn’t mean that Facebook will continue to dominate through its network effect, I don’t know what does.

- Potential Risk

We know that it would be bizarre to expect Facebook’s current growth rate to continue on forever. And the company’s management openly admits that too. Recently, it has warned investors that ad growth will slow in the second half of 2017 as the company starts to capture a larger portion of advertisers. In addition, management remarked that ad load – a term for the amount of a user’s feed that is made up of ads – will only contribute modest growth in the future. All that is understandable considering size and user experience. However, it would be a red flag should ad growth slow to a trickle for an extended period.

Another concern that may catch investors’ eye is the lack of user engagement on the platform. Facebook’s network effect and high-switching cost would make it difficult for competitors to enter the market and existing players are definitely player according to its rules. For instance, Facebook’s Instagram has been emulating Snapchat’s features and that would likely defend the company in an event of a sharp drop-off. The company has spent a lot of time innovating (features such as Facebook Live) to protect its top-dog position and one can be confident that it will continue to be the leader in its field for quite some time.

I like to see a youthful founder on a mission with a big equity stake in his company. Having said that, key-man risk will always be a weakness for an investor who is reliant on the management team to do well. If Zuckerberg were to leave the company, we will need to know for sure that the company has someone in mind to fill his shoes. So far, his vision and ambition has been crucial to the company’s success from a product and culture perspective. His departure would be a good reason to reconsider this investment thesis.

- Conclusion

The best growth companies often get passed over by investors focused on quarterly earnings rather than on great leaders delivering long-term value. With its dominant position in social media among a wide swath of users and wide avenues of opportunity ahead, Facebook offers great potential for investors who would consider adding it to their portfolios today.

Marcus Ho

Research Analyst, Mind Kinesis Value Investing Academy

Disclaimer: Please note that all information stated in this article is just for education purpose only and should not be used as any form of recommendation or advice.