As soon as Jack receives his pay cheque, a large chunk of it goes to settling his credit card bills. He knows that rolling over credit card expenses is a sure way to the poor house. After all, most credit card companies charge anything up to 24 percent interest (or more) per annum. And you think the moneylenders of old were bad!

However, 5 years after entering the workforce, Jack still did not have much savings and no investments to speak of. Time had moved fast in a whirl of clubbing, merrymaking and frequent holiday trips. Fishing off Tioman. Skydiving in Pattaya. Diving in Palawan. And of course the women, willing women. Life could not have been better.

Then, he met Tianna. A goddess. He knew she was the one he wanted to spend the rest of his life with. And it was electrifying when she felt the same way about him.

Jack’s mind turned to the life ahead. Marriage. Setting up home. Tianna was doing her part and, in fact, was way ahead in the realms of financial prudence. Though she too had been living a good life, she was also careful with her money. Tianna was one of the girls who was so beautiful, she looked stunning even in tees and jeans. In fact, come to think of it, Jack realised that Tianna always wore simple but elegant clothes. The more he begun to really notice her, the more he realised her attractiveness came from within. Yes, she was the one for him.

When he graduated, Jack had set a goal to become financially free to do “what he wants to do and not what he has to do”.

But after 5 years, and with marriage beckoning, he was nowhere nearer that goal.

Instead of hiding his financial situation, Jack took a leap of faith and approached Tianna for advice. How did she do it? She was not rich but was certainly better off financially than him – and they had both been in the labour force for about the same number of years.

How did Tianna do it?

Her advice was simple, “Categorize your spending and cull the non-essentials”. Apparently, she had read an article from a certain Garrett Gunderson, CEO of WealthFactory.com, and had followed the advice.

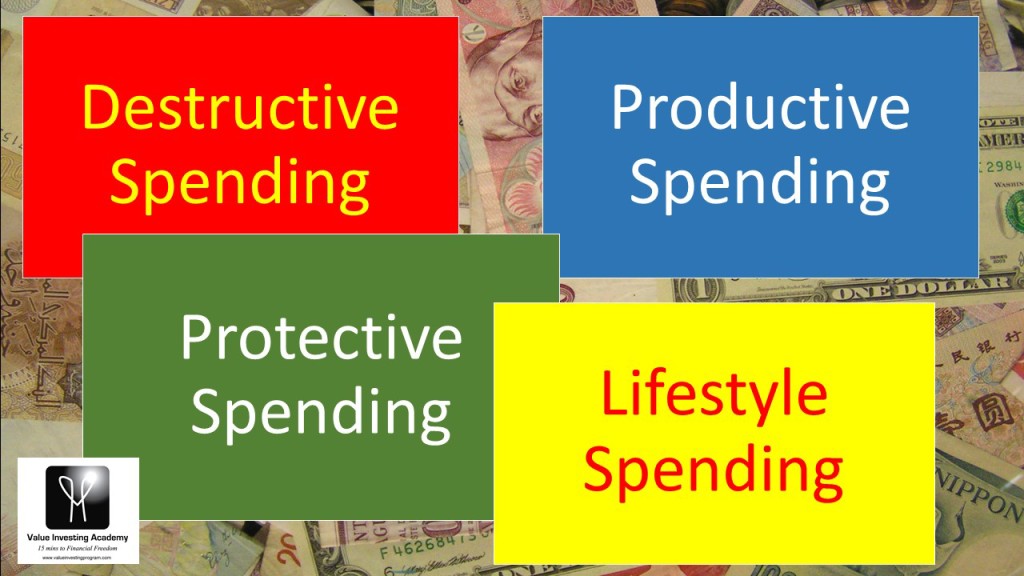

She broke down her expenses into 4 categories:

- Destructive spending

- Productive spending

- Protective spending, and

- Lifestyle spending.

Destructive spending are expenses incurred on credit, on vices such as smoking and excessive drinking – Jack groaned as he had succumbed to the occasional binge drinking – and buying stuff he did not need or did not use after the initial novelty wore off.

Productive spending generates income. This are usually investments in stocks and businesses. They also include potential income generators such as training and education. Productive expenses also include personal well-being products such as nutritious food, physical fitness regimes and general health. Although this third group of productive expenses do not generate income as such, they prevent the leakage of money due to health issues.

Protective spending covered expenses for insurance – health, life, motor, and so forth.

Lifestyle spending consists of vacations, clothing, gadget and trinkets. This adds balance to one’s life, and allows for enjoyment but in moderate portions. “We need to reward ourselves for little successes and this keep us motivated for the long haul,” said Tianna.

She further suggested that Jack stop the destructive expenses immediately. It was for him to moderate his lifestyle and she was already helping him in this regards. When she mentioned “helping”, Jack knew she was referring to more than the “advice” proffered. She was referring to herself. She was not an “expensive” girlfriend to maintain. As a matter of fact, when they went out, most times she paid her own way.

“And the money you save,” said Tianna, “invest it in good businesses that provide consistent and steadily increasing dividends.”

“Will that set me up to becoming a rich man?”

“That will set us up to becoming a rich couple,” replied Tianna.

Obviously, Jack made the right choice, in more ways than one.

Categorizing expenses is the first step. The logical second step is to grow one’s savings. You do that by value investing. In time, Tianna will tell Jack how that works, and that will lead to their financial security and freedom.

Meanwhile, if you want to know how you can secure financial security and freedom, make the move.

Invest 3 hours of your time and take it from there.

************

******************