What is Exchange Traded Funds (ETFs) ?

An exchange-traded fund (ETF) is an investment vehicle that allows investors to buy an entire basket of securities through a single security on a stock exchange . ETFs track and aim to replicate the returns of a particular stock market index, some of which are well known indices such as the , while others are based on specific themes such as a specific geographic region or industry.

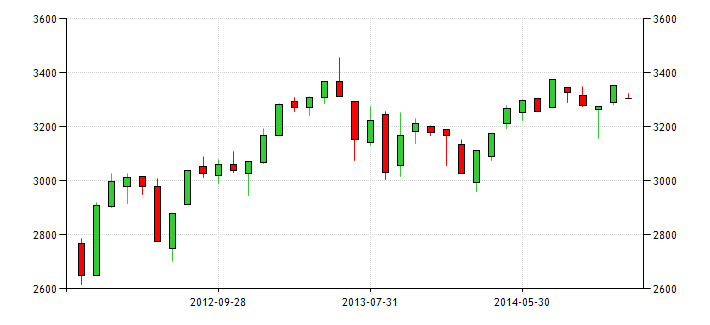

You can invest in The Straits Times Index (SGX: ^STI) or even just broad-based commodities too. So instead of investing in commodity trading companies like Olam International (SGX: O32) or Noble Group (SGX: N21) to gain exposure to commodities, we can invest directly in them through commodity-ETFs.

Why ETFs ?

ETFs are good for investors looking for diversification quickly. Let’s look at the Advantages of ETFs.

There are several advantages to ETFs that make them attractive to investors.

- Management fees are significantly lower for ETFs compared to mutual funds because the underlying portfolio is generally not actively managed.

- They also provide an economical way of obtaining diversification and market exposure since an ETF unit represents an investment across an entire index. ETFs can be purchased and sold any time the market is open, unlike mutual fund transactions, which are executed only at the end of a trading day.

- ETFs allow the investor to sell short and exercise limit orders on the ETF similar to other securities listed on the stock exchange.

- You can purchase an ETF with one single transaction. You are purchasing a mini-portfolio, not a basket of stocks. That makes life easier when targeting a certain price. You also get filled on your complete order as opposed to a basket where you are chasing each individual stock.

- Since there is only one transaction per trade, commissions are lower on an ETF as opposed to an index, which requires a basket of stocks and multiple trades.

- ETFs are simple in structure and easy to understand. If you are looking to invest in a certain industry or want to emulate the ROI on a particular index or underlying asset, you are only a trade away from getting started with ETFs.

Will share more about STI ETFs Saving Plan next post! In the meantime, do join us for a live workshop to discuss more! To learn more about how to invest, join us in our Free Investing Workshop at

Mumtaj Bagum

Programme Manager, Mind Kinesis Investments Pte Ltd