Diversification or Diworsification

SUMMARY

- Investors have been told that diversification will enable them to reduce risk and achieve their financial goals

- How can we better understand diversification when we take into account our current financial health

- Depending on your goals, diversification can either help or harm you

- Introduction

Most people think that if something is good, more is always better. But that is rarely true. One of the most important concepts in economics, The Law of Diminishing Returns, shows us that each new unit of something good tends to produce less good than the previous unit. Here is a graph to illustrate my point:

Source: https://personalexcellence.co

Source: https://personalexcellence.co

Instead of thinking about the total output and the total input, let’s think about this as eating chocolate. The first piece is always the most satisfying. However, no matter how much you love chocolate, the 10th piece doesn’t give you as much pleasure as the first one and the 100th piece (if you make it to this point) makes you sick.

Despite the economic roots of this concept, many economists (and much of Wall Street) think this issue doesn’t apply to the diversification of equity portfolios. But in this article, it will show that more is not always better and the value of diversification diminishes much faster than most people think.

- How does diversification work?

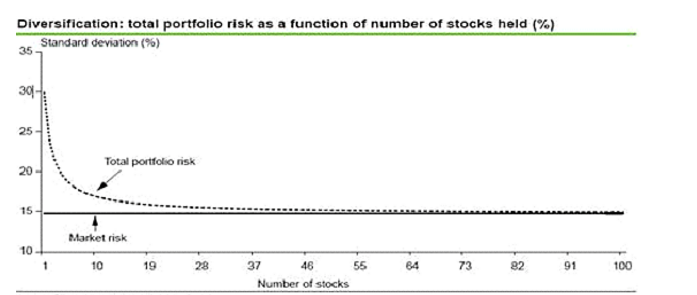

The chart below, based on data from the classic book A Random Walk Down Wall Street by Burton Malkiel, shows how adding a third or seventh or fifteenth position to an equity portfolio materially reduces the volatility of returns. However, by the time a portfolio has twenty or so holdings, the incremental reductions in portfolio volatility from new holdings is very small.

According to Burton Malkiel, who himself is a strong proponent of diversification mentioned that when a portfolio contains 20 stocks from various industries and sectors which have equal amounts invested in them, the total risk of the portfolio falls by almost 70%. From there on, a further increase in the number of stocks in a portfolio does not have a significant impact on reducing the overall risk of the portfolio.

From the graph above, we should note that there are two different types of risks at play here: market risk and specific risk.

Market risk is defined as the risk of the stock market crashing. When such an event occurs, it does not matter how many stocks one has in his portfolio; they will all tank at the same time. Hence, market risk is one that every investor, regardless of his methodology, must bear when investing in the stock market.

A specific risk is defined as a risk (operational or financial) that a company faces when it is in operation. For instance, Chipotle’s food poisoning scandal which took place in August 2015 is a specific risk. It affects only Chipotle and no other business.

Needless to say, investors do not seek only to reduce risk. They also want to maximize returns. Any active stock picker will hope that they eventually outperform the general market. However, it becomes clear very quickly that it is quite hard to find a lot of good ideas that will continue to succeed over long periods of time. A realistic investor knows that even their best idea has a very good chance of underperforming, despite their best efforts. So a smart investor will build a portfolio of a number of stocks that they expect will beat the market. But there are limits to the number of stocks an investor can know well and have a reasonable basis to believe will outperform. So while more stocks will reduce volatility, it also requires adding stocks to the portfolio that the investor believes has less potential to outperform.

- Conclusion

Diversification is great, but its benefits are realized with far fewer stocks that most people realize. The important takeaway is to identify what your goal.

If it is to match the market performance, one can simply invest in a basket of stocks such as an exchange traded fund (ETF). But in order to beat the market, the level of diversification should be optimized, not maximized. What investors should avoid at all costs is attempting to beat the market by applying strategies that causes excessive diversification.

Marcus Ho

Research Analyst, Mind Kinesis Value Investing Academy

Disclaimer: Please note that all information stated in this article is just for education purpose only and should not be used as any form of recommendation or advice.