Overview

Dukang Distillers Holdings Limited is an investment holding company which engages in the manufacturing and selling of baijiu products in the People’s Republic of China.

Baijiu is a Chinese distilled alcoholic beverage which literally means “white liquor,” “white alcohol” or “white spirit.” It is generally about 40-60% alcohol by volume. Baijiu is normally distilled from sorghum, wheat, barley and millet. It is served in shot glasses similar to the style of drinking sake.

The company has a range of baijiu products sold and marketed under the Dukang and Siwu brand names. Its product series under Dukang brand include “Jiuzu Dukang”, “Guohua Dukang” and “Lao Dukang” series. Its product series under Siwu brand include “Yu Shang Jiu”, “Siwu Old Cellar 1949”, “New Laojiao Zhencang” and “Jin Yu Zun”.

According to an analyst report by RHB Research, Dukang commands a 3% market share in the Henan province. The top three baijiu players in China are Kweichow Moutai, Wuliangye, Yunghe.

It is noteworthy that Dukang was also featured in the Forbes’ Asia’s 200 Best under a Billion list this year. Dukang went public in September 2008. Currently, it is trading at a PE ratio of 4.3.

Financials

Dukang released its full year of 2013 (ended 30th June 2013) results on 28th August 2013. The revenue for FY2013 increased 31.7% to RMB2.4 billion and the net profit ballooned 78.7% to RMB389.7 million. The revenue growth was due to the increase in revenue from Luoyang Dukang operations. The gross profit margin (GPM) improved from 37.5% in FY2012 to 40.9% FY2013 due primarily to the higher overall GPM of 44% for Dukang brand products.

On its balance sheet, it carried RMB84 million of total debt and it had cash and cash equivalents of RMB757.6 million. It generated cash flow from operations of RMB RMB544.8 billion for FY2013. With capital expenditure at RMB344.4 million, the free cash flow came up to be RMB200.4 million.

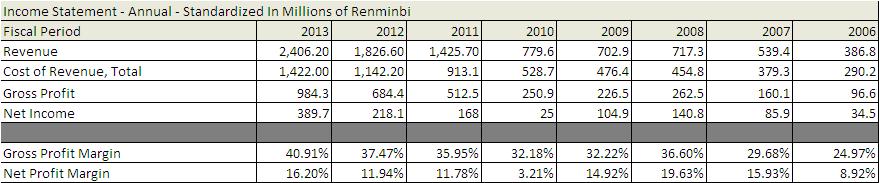

Below is a snapshot of the income statement from 2006 to 2013:

It can be seen that revenue has risen from RMB386.8 million in 2006 to RMB2.4 billion in 2013. This is a growth of 29.8% per annum. The net profit grew from RMB34.5 million to RMB389.7 million, which is a growth of 41.3%.

The gross profit margin was the highest in 2013 at 40.9%.

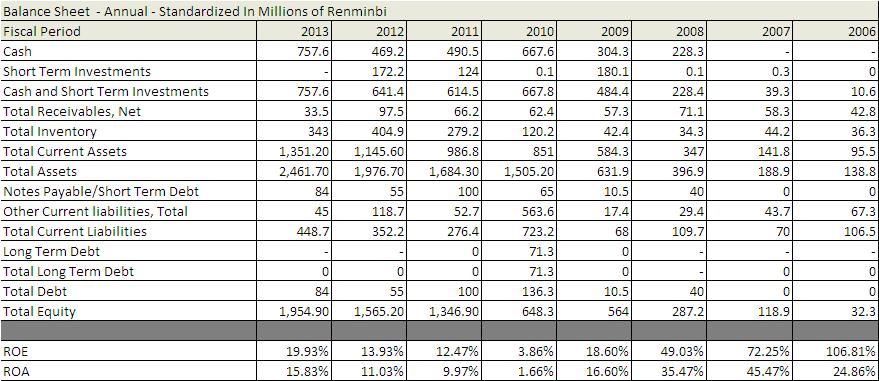

Now let’s take a look at the balance sheet from 2006 to 2013:

As mentioned above, the company had RMB84 millions of total debt and it had a cash position of RMB757.6 million in FY2013. The ROE and ROA are at 19.9% and 15.8% respectively.

As for the cash flow, there was a huge jump in cash flow from operations from 2012 to 2013. This was mainly due to the better profitability in 2012. The cash flow was negative for 2011 and it was mainly due to changes in working capital – increase in inventories and increase in prepayments.

Conclusion

Dukang currently trading at a PE of 4.3 might seem like a steal but it warrants further action. How is the competitive landscape in this industry? Dukang may face lots of competition in the segmented market as it only commands a 3% market share. There are other competitors as mentioned above.Are the competitors bigger than Dukang?

Do note that Dukang does not pay any dividends. With the saga surrounding S-chips and cash which-is-in-the-balance-sheet-but-not-in-the-bank problem, potential investors might want to look into the company deeper and maybe even pay a visit to the factories in China.

While in China, potential investors might also want to visit the shops selling baijiu and observe the how the products are being sold. Are Dukang’s baijius placed at a strategic position to capture the attention of interested buyers? Are many people buying the products of Dukang or are they instead purchasing the products of their competitors? How is the pricing of Dukang’s products compared to that of their rivals?

This article serves as a stepping stone in the right direction and is by no means a holy grail. Own due diligence and independent thinking are necessary if investors are to do well in the stock market.

Happy Investing!

Cheers!

Sudhan, Business Analyst

Mind Kinesis Value Investing Academy