We will continue our discussion using STEP analysis to determine if a stock has an Economic Moat that can survive different aspects of a market.

This is a follow up from the last post. https://www.investment-in-stocks.com/investment-in-stocks/analyzing-a-stocks-economic-moat-using-step-analysis-part-1

In our previous post, we have discussed the first 2 factors of STEP, namely Social Cultural and Technological.

This post we will look at asking questions regarding Economic and Political Factors.

Economic – As a value investor, I want to find a business that is not very much affected by poor economy. One way to determine this is to look for non-cyclical stocks. These are businesses that provides goods and services that will continue to be in demand regardless of the market condition. Can you think of some products and services you will continue to pay for regardless if you get a pay increase or pay cut. Luxury items such as travel and a nicer pair of watch would probably not fit that criteria.

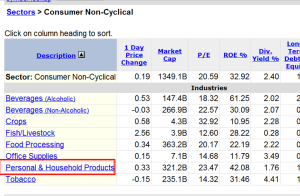

A good starting place to search for such stocks and businesses will be to look at non cyclical sectors under Yahoo and Google Finance.

You can see a list of broad categories of business listed. Personally, i will continue to explore under the Personal and Household Products as it is the simplest to understand.

Just clicking through the link brings me to a list of businesses classified as non cyclical.

Just one glance at the list, i have already identified one business providing me products I use on a daily basis regardless of the economy. Colgate-Palmolive. Yes, i brush my teeth daily and I do hope you do too.

While analysing a stock, we should take care that the business has the ability to do well in good times and survive the bad times. A business that satisfy this criteria is a business call NIKE. Nike is a business that will do well in good times. Being a sportsperson myself, I view Nike as a premium brand and like the material as well as the design. So generally speaking, Nike appeal to people who would be willing to pay the premium.

But can it survive bad times? One interesting thing about Nike is that it does not own or operate factories for production. So what does this mean? This means Nike does not bear the burden of having to pay the fixed expenses of maintaining the factories, the machinery, the payroll etc. It outsources its productions and so when the economy is not doing as well, Nike merely needs to reduce its order and thus reducing its expenses very quickly. It is a flexible and asset – light business.

Political Factors – The last factor in the STEP analysis is Political Factors. When government regulations come into play, it can affect a business. When analyzing a factor, we want a business that is supported by government regulations or at least, is neutral.

A business I can think of is our dear SGX. Singapore Exchange is the only legal stock exchange dealing with Singapore Stocks and it is likely to continue to be a monopoly because government regulations actually protects it from competition. Other such businesses that benefits from Political factors include SMRT, ST Engineering. Some other industries which may benefit include healthcare, education etc.

I would avoid businesses that is obviously harmful to the society. Perhaps gambling or smoking. This is because the government will be under pressure to regulate the activities of such businesses.

But it is all relative. When the government restricts activities, it may actually be beneficial for certain companies. it is likely that the amount of Casinos allowed in Singapore is going to be restricted. This will mean that there is unlikely going to be competitors for Genting and MBS.

So in summary, the idea of looking for a business with Economic Moat had always been a key interest for Value Investors. But the “how to” is always subjective. In these 2 posts, we have discussed through a possible framework to test out the strength of the possible moat of a business.

Using a systematic approach can enable us to significant reduce risk of investing by studying into a business.

Learn more together with us “live” as we analyse stocks together.

Click HERE to book a Free Investing Workshop.

To your dreams,

Mind Kinesis Research Team

Master Trainer (Value Investing Options Strategy)

Investment in Stocks Blog

Value Investing Academy – the Warren Buffett Way

https://www.investment-in-stocks.com,